Table of Contents

1. Aditya Birla Sun Life Frontline Equity Fund: Overview

Aditya Birla Sun Life Frontline Equity Fund is an open ended equity scheme predominantly investing in large cap stocks.

2. Aditya Birla Sun Life Frontline Equity Fund: Investment Objective

- Long term capital growth. The portfolio aims to invest 100% in equities, focusing on spreading investments across different industries and sectors, similar to the NIFTY 100 TRI benchmark index.

- Income generation and distribution of IDCW.

3. Aditya Birla Sun Life Frontline Equity Fund: Fund Details

The Fund has achieved a notable compound annual growth rate (CAGR) of 15.96%, showcasing its strong performance in the equity market. As of October 18, 2024, the fund’s latest Net Asset Value (NAV) is ₹578.37. With an impressive Assets Under Management (AUM) of ₹31,389.18 crores as of September 30, 2024, this fund strategically invests in large-cap stocks, aiming to deliver substantial long-term capital appreciation while ensuring a well-diversified portfolio that aligns with the NIFTY 100 TRI benchmark.

| Inception Date | NA |

| CAGR | 15.96% |

| Latest NAV | ₹ 578.37 (as on October 18, 2024) |

| AUM | ₹ 31,389.18 Crores (September 30, 2024) |

| Risk | Very high risk |

| Investment Horizon | 5 or more years |

| Min Investment | ₹ 100 |

| Entry load | NIL |

| Exit load | 1% |

4. Aditya Birla Sun Life Frontline Equity Fund: Other Deatils

The Aditya Birla Sun Life Frontline Equity Fund boasts a Total Expense Ratio (TER) of 0.96%, highlighting its cost-effectiveness in managing investor funds. Its Beta Ratio of 0.94 indicates that the fund is slightly less volatile than the broader market, making it a relatively stable choice for investors.

A Sharpe Ratio of 0.94, the fund demonstrates strong risk-adjusted returns, suggesting that it effectively balances risk and reward.

The Standard Deviation of 11.82% points to moderate fluctuations in returns, providing insight into its performance consistency.

Furthermore, with a portfolio turnover of ₹38.00 crores and a remarkable Net Equity Exposure of 98.69%, the fund emphasizes its focus on equity investments, positioning itself well for long-term growth opportunities.

| Total Expense Ratio (TER) | 0.96 % |

| Beta Ratio | 0.94 % |

| Sharpe Ratio | 0.94 % |

| Standard Deviation | 11.82 % |

| Portfolio Turnover | ₹ 38.00 CRs |

| Net Equity Exposure | 98.69 % |

5. Aditya Birla Sun Life Frontline Equity Fund: Fund Managers

Mr. Mahesh Patil

Mahesh Patil is the Chief Investment Officer (CIO) at Aditya Birla Sun Life AMC Limited, managing assets worth INR 3 lakh crore.

He has over 30 years of experience in fund and investment management and has been with Aditya Birla Sun Life AMC since October 2005.

Mahesh holds a Bachelor’s degree in Engineering from VJTI, an MBA from JBIMS, and is a qualified Chartered Financial Analyst. He received the India CIO of the Year award in 2016 and the Chairman’s Individual Award in 2015.

Mr. Dhaval Joshi

Dhaval Joshi has 15 years of experience in equity research and investments.

Before joining Aditya Birla Sun Life AMC Limited, he spent about 5 years at Sundaram Mutual Fund and has also worked as a research analyst at Emkay Global Financial Services and Asit C Mehta Investment Intermediates Ltd.

He is currently part of the investment team at Aditya Birla Sun Life AMC.

6. Aditya Birla Sun Life Frontline Equity Fund: Top 10 Holdings

| Stock Name | % of Net Assets |

| HDFC Bank Ltd. | 7.75 % |

| ICICI Bank Ltd. | 7.05 % |

| Infosys Ltd. | 6.09 % |

| Reliance Industries Ltd. | 5.07 % |

| Larsen & Toubro Ltd. | 4.56 % |

| Housing Development Finance Corporation Ltd. | 3.60 % |

| Bharti Airtel Ltd. | 3.60 % |

| Mahindra & Mahindra Ltd. | 3.06 % |

| NTPC Ltd. | 3.03 % |

| Axis Bank Ltd. | 2.96 % |

7. Aditya Birla Sun Life Frontline Equity Fund: Top 5 Sectors

| Sector | % of Net Assets |

| Financials | 27.69% |

| Energy | 9.58% |

| Technology | 9.13% |

| Automobile | 8.34% |

| Consumer Staples | 7.22% |

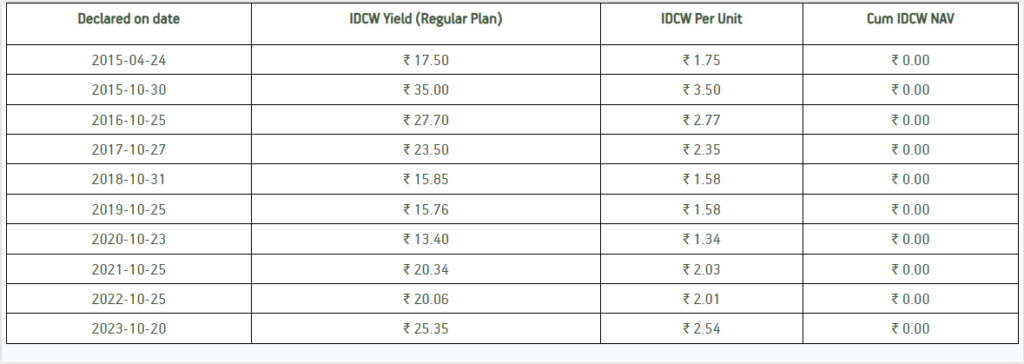

8. Aditya Birla Sun Life Frontline Equity Fund: Dividend History

Any income received under this option would be considered as income for the investors and hence would be taxed at applicable tax slab rates.

Investment Performance:

IDCW (Income Distribution Cum Capital Withdrawal) Plan of this scheme has distributed income to its investors out of its earnings, from time to time. The details of the same is tabulated:

Disclaimer: No content on this website should be treated as investment advice. All the content offered on the website is for informational purposes only. Please contact your adviser before making an investment.

FAQs:

Is the ABSL Frontline equity fund good?

What is the NAV of Birla Frontline fund?

You may also read:

IPOs : https://thebalancedportfolio.com/waaree-energies-ipo-ipo-size-ipo-key-date/