Table of Contents

1. Hyundai India IPO : About Hyundai Company

Hyundai Motor Company has long been a leader in Korea’s automotive sector, starting with the launch of the Pony, which showcased its innovative technology. Today, it stands as a globally recognized automobile manufacturer, exporting vehicles to over 200 countries and maintaining production facilities worldwide. Hyundai is at the forefront of expanding the automotive landscape, notably with its pioneering efforts in mass-producing hydrogen-powered vehicles. The company also introduced GENESIS, its luxury brand, while driving advancements in autonomous driving and connectivity technologies. As Hyundai prepares for the Hyundai India IPO, it aims to leverage its technological innovations to create better solutions for humanity, all under its guiding principle of “Progress for Humanity.”

2. Hyundai India IPO : About Hyundai IPO

- 1996: Hyundai Motor India Limited was founded, marking the entry of the Hyundai brand into the Indian automotive market.

- 2000s: The company rapidly expanded its manufacturing capabilities and product offerings, establishing a strong presence in the domestic market.

- 2005: HMIL became the top exporter of passenger vehicles in India, a title it has maintained since.

- 2020s: The company has focused on sustainability and innovation, launching several EV models to cater to the growing demand for eco-friendly vehicles

Hyundai Motor India Limited (HMIL), a wholly owned subsidiary of Hyundai Motor Company (HMC), is gearing up for an exciting milestone with its upcoming Hyundai India IPO. This move aligns with HMC’s global vision of “Progress for Humanity,” emphasizing sustainable practices and innovative mobility solutions.

Operating a robust network of 1,366 sales points and 1,550 service centers across the country, HMIL caters to a diverse range of customers. Its impressive lineup includes popular models like the Grand i10 NIOS, i20, and the all-electric IONIQ 5, reflecting the brand’s commitment to meet evolving consumer needs while embracing eco-friendly technology.

The state-of-the-art manufacturing facility near Chennai is optimized for producing a full range of vehicles, making HMIL a key player in HMC’s global export strategy. With exports reaching markets in Africa, the Middle East, and South Asia, Hyundai is not just an Indian automotive leader but also a significant contributor to the global supply chain.

3. Hyundai India IPO : IPO Dates

The Hyundai India IPO is set to open on Tuesday, October 15, 2024, and will close on Thursday, October 17, 2024. Investors eagerly awaiting this opportunity will find the basis of allotment announced on Friday, October 18, 2024. Following the allotment, the shares will officially list on the stock exchange on Tuesday, October 22, 2024.

| Sr. No. | Particulars | Dates |

| 1 | IPO Open date | 15 October 2024 |

| 2 | IPO Close date | 17 October 2024 |

| 3 | IPO Allotment date | 18 October 2024 |

| 4 | IPO Listing date | 22 October 2024 |

4. Hyundai India IPO : Issue Size and Other Details

Hyundai Motor India is looking to raise approximately $3.3 billion, equivalent to over ₹27,870.16 crore, through its upcoming Hyundai India IPO. Notably, this IPO will not feature any new shares; instead, it will involve Hyundai’s South Korean parent company selling up to 142,194,700 shares (or 14.22 crore shares), which represents 17.5% of its stake in this wholly owned subsidiary. The shares will be offered to retail and other investors via the offer for sale (OFS) route.

With no fresh issue component included, this IPO presents a unique opportunity for investors to engage directly with the established brand’s existing equity.

| Sr. No. | Particulars | Deatils |

| 1 | Issue Size | ₹27,870 Crore |

| 2 | Issue Size Shares | 142,194,700 shares |

| 3 | IPO Price band | ₹1865 to ₹1960 per share. |

| 4 | IPO Lot size | 7 Shares ( ₹15,000/ ₹1,960) |

| 5 | Promoters share holding pre IPO issue | 812,541,100 Shares |

| 6 | Employee discount | ₹180 per share. |

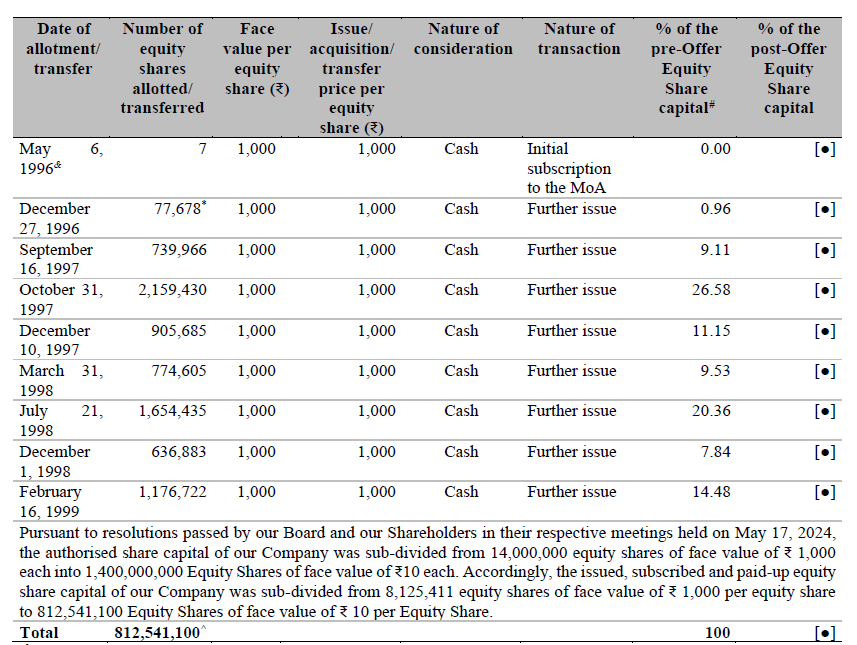

The below table shows the total breakup of 812,541,100 Shares.

Source : Hyundai India IPO DRHP. https://www.sebi.gov.in/filings/public-issues/jun-2024/hyundai-motor-india-limited-drhp_84186.html

5. Hyundai India IPO : IPO Reservation

In the upcoming Hyundai India IPO, the allocation of shares is designed to cater to various investor categories. Up to 50% of the net issue will be offered to Qualified Institutional Buyers (QIBs), highlighting the company’s appeal to institutional investors. Additionally, retail investors will have access to a minimum of 35% of the net issue, ensuring broad participation from individual stakeholders. Lastly, Non-Institutional Investors (NIIs), often referred to as High Net Worth Individuals (HNIs), will be allocated at least 15% of the net issue. This structured distribution aims to create a balanced investment opportunity for all types of investors in the Hyundai India.

| Sr. No. | Reservation Category | Reservation % |

| 1 | QIB (Qualified Institutinal Buyers) | 50% |

| 2 | Retailers | 35% |

| 3 | NII / HNI | 15% |

6. Hyundai India IPO : IPO Objectives

Hyundai India IPO, the Company will not receive any proceeds from the Offer (the “Offer Proceeds”) and all the Offer Proceeds will be received by the Promoter Selling Shareholder after deduction of Offer related expenses and relevant taxes thereon, to be borne by the Promoter Selling Shareholder.

- To carry out the Offer for Sale of up to 142,194,700 Equity Shares of face valueof ₹ 10 each by the Promoter Selling Shareholder aggregating up to ₹ 27,870 crore;

- Achieve the benefits of listing the Equity Shares on the Stock Exchanges.

Hyundai India IPO is a complete OFS, promoters are selling their holdings.

7. Hyundai India IPO : Book Running Lead Managers

The Hyundai India IPO will be supported by a strong lineup of leading financial institutions serving as underwriters. Notable names include Kotak Mahindra Capital Company Limited, Citigroup Global Markets India Private Limited, and HSBC Securities and Capital Markets (India) Private Limited. Additionally, Morgan Stanley India Company Private Limited will also play a pivotal role in this significant offering. This esteemed group of underwriters is expected to enhance the IPO’s visibility and attract a wide range of investors, further solidifying Hyundai’s presence in the Indian market.

- Kotak Mahindra Capital Company Limited

- Citigroup Global Markets India Private Limited

- HSBC Securities and Capital Markets (India) Private Limited

- HSBC Securities and Capital Markets (India) Private

- Morgan Stanley India Company Private Limited

8. Hyundai India IPO : Key Financials Summary

| Particulars | For the Period Ended June 30, 2024 | For the year ended 31.03.2024 | For the year ended 31.03.2023 | For the year ended 31.03.2022 |

| Revenue (₹ millions) | 175,679.84 | 713,023.25 | 614,366.42 | 479,660.48 |

| Profit After Tax (₹ millions) | 14,896.52 | 60,600.44 | 47,092.50 | 29,015.91 |

| Earnings Per Share (₹) | 18.33 (Not annualised) | 74.58 | 57.96 | 35.71 |

| Total Equity (₹ millions) | 121,487.10 | 106,656.57 | 200,548.18 | 168,562.55 |

| Total Assets (₹ millions) | 253,702.39 | 263,492.45 | 345,733.42 | 283,580.58 |

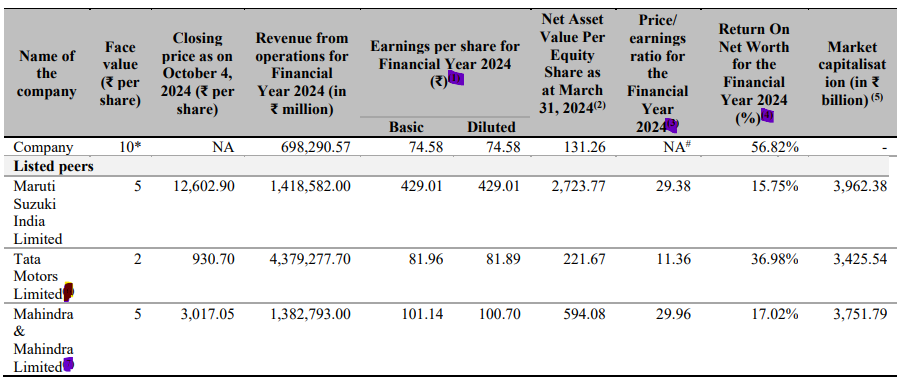

9. Hyundai India IPO : Comparison of accounting ratios with listed industry peers

For the Hyundai India IPO, a peer group has been identified based on companies listed on Indian stock exchanges that share similar business profiles. These companies were selected due to their comparable size and business models, providing a relevant context for assessing Hyundai’s market positioning. By analyzing this peer group, investors can gain insights into Hyundai’s competitive landscape and understand its potential within the Indian automotive sector. This comparison will be instrumental for stakeholders as they evaluate the upcoming IPO and its significance in the market.

10. Hyundai India IPO : Hyundai Korea Stock Performance

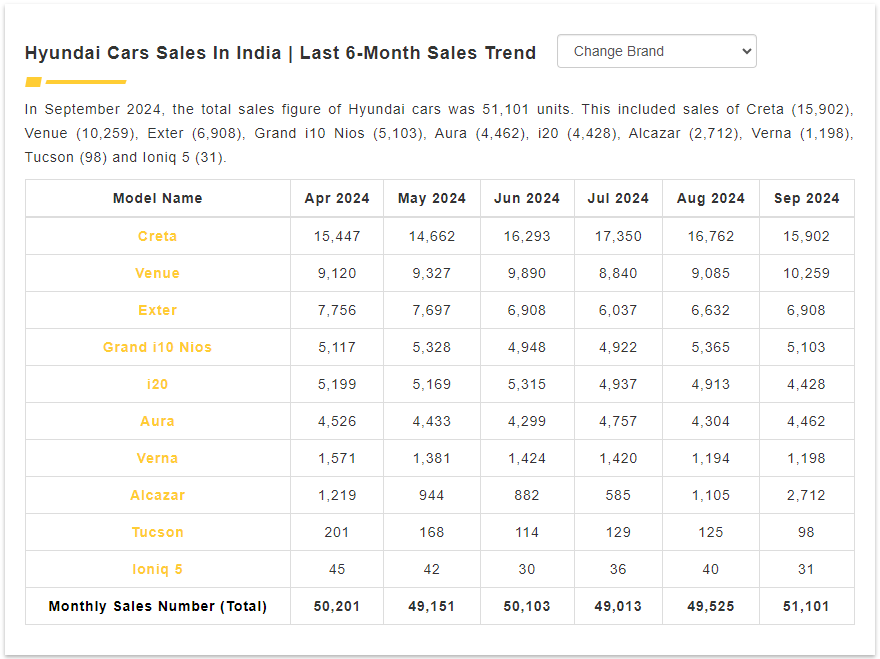

11. Hyundai India IPO : Hyundai India Sales Figures

The below table shows monthly Hyundai car sales in India.

Source: https://www.v3cars.com/hyundai-cars-monthly-sales

12. Hyundai India IPO : Can subsidiary company apply for IPO?

Yes, a subsidiary company can pursue an IPO in India. However, it must navigate several regulatory requirements established by the Securities and Exchange Board of India (SEBI) and comply with the Companies Act. This includes presenting a strong financial history and demonstrating effective corporate governance.

The subsidiary needs to ensure full transparency in its financial disclosures and reporting. If the IPO involves selling shares that could impact the parent company’s ownership stake, approval from the parent may also be necessary. While the path to an IPO is certainly possible for a subsidiary, it requires thorough preparation and adherence to the relevant regulations.

Disclaimer: No content on this website should be treated as investment advice. All the content offered on the website is for informational purposes only. Please contact your adviser before making an investment.

Relevant links for further reading:

Upcoming IPOs: https://thebalancedportfolio.com/upcoming-ipos-in-2024-25/

Afcons IPO: https://thebalancedportfolio.com/afcons-infrastructure-limited-ipo/