Table of Contents

1. Swiggy Limited IPO: About the Company

Swiggy (Swiggy Limited IPO) has established itself as a modern, consumer-focused technology platform that streamlines convenience for users. With its integrated app, customers can easily explore, order, and pay for a wide range of items, from food to groceries. The efficient on-demand delivery network ensures that orders are swiftly delivered to customers’ doorsteps, enhancing the overall experience.

In addition to food delivery and grocery services, Swiggy offers functionalities like Dineout for restaurant reservations and SteppinOut for event bookings. The platform also features Genie for hassle-free product pick-up and drop-off, catering to various hyperlocal needs. As a pioneer in the hyperlocal commerce landscape, Swiggy has made significant strides since launching its Food Delivery service in 2014 and expanding into Quick Commerce in 2020, solidifying its reputation as a leader in innovation and convenience in India.

2. Swiggy Limited IPO: History of the Company

Incorporation: Established as Bundl Technologies Private Limited on December 26, 2013, under the Companies Act, 1956 in Andhra Pradesh.

Office Relocation: Moved registered office from Andhra Pradesh to Karnataka on November 2, 2015, with a special resolution on December 11, 2015.

New Registration: Received a fresh certificate of registration from the Registrar of Companies, Karnataka, on September 19, 2016.

Name Change: Changed name to Swiggy Private Limited following Board and shareholder resolutions on January 25, 2024, and February 19, 2024; fresh certificate issued on April 1, 2024.

Conversion to Public Company: Converted to a public limited company with resolutions passed on February 14, 2024, and February 19, 2024; name changed to Swiggy Limited.

Final Registration: Fresh certificate of incorporation for Swiggy Limited issued on April 10, 2024.

3. Swiggy Limited IPO: Business Model

Revenue

Swiggy earn revenue from sale of services and sale of goods on our platform. Swiggy revenue from services primarily includes,

- Commissions that we charge to our restaurant partners and merchant partners which is a function of the perceived value of our offerings to them on our platform,

- Advertising revenue that we earn from restaurant partners, merchant partners and brand partners for our advertising tools and services,

- Fees that we charge to users and delivery partners for the use of our technology platform and

- Subscription revenue that we earn from users for our Swiggy One membership program.

Revenue from sale of goods primarily relates to revenue earned from the sale of products as part of our Supply Chain and Distribution business, described below.

Five business segments.

- Food Delivery

- Out-of-home Consumption

- Quick Commerce

- Supply Chain and Distribution

- Platform Innovations

4. Swiggy Limited IPO: IPO Details

| Particulars | Details |

|---|---|

| IPO Date | November 6, 2024 to November 8, 2024 |

| IPO Date Allotment | Monday, November 11, 2024 |

| IPO Listing Date | Wednesday, November 13, 2024 |

| Price Band | ₹371 to ₹390 per share |

| Total Issue Size | 290,446,837 shares (aggregating up to ₹11,327.43 Cr) |

| Fresh Issue | 115,358,974 shares (aggregating up to ₹4,499.00 Cr) |

| Offer for Sale | 175,087,863 shares of ₹1 (aggregating up to ₹6,828.43 Cr) |

Swiggy Limited IPO: IPO Reservation:

| Investor Category | Reserved % |

|---|---|

| QIB | Not More than 75% of the Net Issue |

| Retail | Not more than 10% of the Net Issue |

| NII (HNI) | Not more than 15.00% of the Net Issue |

5. Swiggy Limited IPO: Objectives of the IPO issue

We propose to utilise the Net Proceeds towards funding the following objects:

1. Investment in our Material Subsidiary, Scootsy, for repayment or pre-payment, in full or in part, of certain or all of its borrowings;

2. Investment in our Material Subsidiary, Scootsy, for: (a) expansion of our Dark Store network for our Quick Commerce segment through setting up of Dark Stores; and (b) making lease / license payments for Dark Stores;

3. Investment in technology and cloud infrastructure;

4. Brand marketing and business promotion expenses for enhancing the brand awareness and visibility of our platform, across our segments; and

5. Funding inorganic growth through unidentified acquisitions and general corporate purposes.

6. Swiggy Limited IPO: Key Financial Information

| Particulars | Period ended 30.06.2024 | Year ended 31.03.2024 | Year ended 31.03.2023 | Year ended 31.03.2022 |

|---|---|---|---|---|

| Revenue | 33,101.11 | 116,343.49 | 87,144.53 | 61,197.77 |

| Loss Before Tax | (6,110.07) | (23,502.43) | (41,793.05) | (36,288.96) |

| Assets | 103,412.42 | 105,294.21 | 112,806.45 | 144,057.36 |

| Equity | 74,449.92 | 77,914.61 | 90,566.12 | 122,669.12 |

| Liabilities | 28,962.50 | 27,379.60 | 22,240.33 | 21,388.24 |

7. Swiggy Limited IPO: Key Financial Ratios

| Particulars | Period ended 30.06.2024 | Year ended 31.03.2024 | Year ended 31.03.2023 | Year ended 31.03.2022 |

|---|---|---|---|---|

| Loss per share | (2.76) | (10.70) | (19.33) | (18.62) |

| Return on Net Worth (%) | (8.21) | (30.16) | (46.15) | (29.58) |

| Net Asset Value per Equity Share (in ₹) | 33.61 | 35.48 | 41.88 | 62.96 |

8. Swiggy Limited IPO: Book Run Lead Managers

- Kotak Mahindra Capital Company Limited

- J.P. Morgan India Private Limited

- Citigroup Global Markets India Private Limited

- BofA Securities India Limited

- Jefferies India Private Limited

- ICICI Securities Limited

- Avendus Capital Private Limited

- Registrar: Link Intime India Private Limited

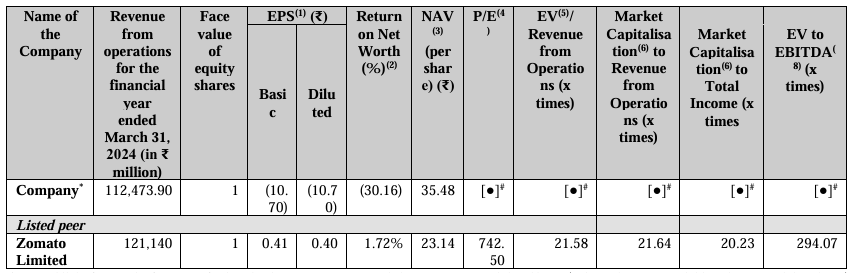

9. Swiggy Limited IPO: Comparison with listed industry peers

Following is a comparison of our accounting ratios with the listed peers:

10. Swiggy Limited IPO: Management

Anand Kripalu:

Position: Independent Director and Chairman of the Board since December 4, 2023.

Education:

- Bachelor’s degree in Electrical Engineering from Indian Institute of Technology Madras.

- Postgraduate Diploma in Management from Indian Institute of Management Calcutta.

- Certification in Advanced Management Program from The Wharton School, University of Pennsylvania.

Current Role: Managing Director and Global CEO at EPL Limited.

Previous Experience:

- Eight years at Diageo in India – United Spirits Limited.

- Roles at Cadbury Schweppes Asia Pacific, Hindustan Lever Limited, and DCM Data Products.

Recognition: Recipient of the “Lifetime Achievement Award” at the 8th Indian Marketing Awards by exchange4media.

Sriharsha Majety

Position: Managing Director and Group Chief Executive Officer of the Company.

Education:

- Bachelor’s degree in Electrical and Electronics Engineering from Birla Institute of Technology and Science, Pilani.

- Postgraduate Diploma in Management from Indian Institute of Management, Calcutta.

Experience: Over 10 years of experience with the Company.

Recognition: Awarded ‘Entrepreneur of the Year 2019’ at ‘The Economic Times Awards for Corporate Excellence’ in November 2019.

Lakshmi Nandan Reddy Obul:

Position: Whole-time Director – Head of Innovation on the Board.

Experience: Over 10 years with the Company.

Education: Master’s degree in Science (Honors) in Physics from Birla Institute of Technology and Science, Pilani.

Previous Experience: Worked as an Associate in Business Consulting at Intellectual Capital Advisory Services Pvt. Ltd. (Intellecap).

Shailesh Vishnubhai Haribhakti

Position: Independent Director of the Company since January 24, 2023.

Professional Memberships:

- Member of the Institute of Chartered Accountants of India.

- Associate member of the Association of Certified Fraud Examiners.

- Certified Financial Planner under the Financial Planning Standards Board India.

- Certified Internal Auditor under the Institute of Internal Auditors, Inc.

- Cleared final examination of the Institute of Cost and Works Accountants of India.

- Conferred the Global Competent Boards Designation by Competent Boards Inc.

Experience: Over 15 years, with previous roles at:

- Blue Star Limited

- L&T Finance Holdings Limited

- Raymond Limited

- Ambuja Cements Limited

- Torrent Pharmaceuticals Limited

Sahil Barua:

Position: Independent Director on the Board since January 24, 2023.

Education:

- Bachelor’s degree in Technology from National Institute of Technology Karnataka, Surathkal.

- Postgraduate Diploma in Management from Indian Institute of Management, Bangalore.

Current Role: Co-founder and Chief Executive Officer of Delhivery Limited for over 11 years.

Previous Experience: Worked as a consultant at Bain and Company India Private Limited for over 2 years.

Suparna Mitra:

Position: Independent Director on the Board since April 1, 2024.Education:

- Bachelor’s degree in Electrical Engineering from Jadavpur University.

- Postgraduate Diploma in Management from Indian Institute of Management, Calcutta.

Current Role: Chief Executive Officer of the Watches and Wearables Division at Titan Company Limited for 18 years.

Board Membership: Serves on the Board of Governors for the Indian Institute of Management, Kozhikode for 5 years.

Previous Experience: Served on the board of Tata Power Solar Systems Ltd.

Recognitions:

- Featured in Fortune’s Most Powerful Women in Business.

- Listed in Business Today’s Most Powerful Women in Business.

- Honored as BW Businessworld’s Most Influential Women 2022.

- Received the ET Femina Most Promising Women Leaders Award in 2022.

- Recognized as India’s Impactful CEO 2023 by ET Edge.

- Named among Business Today’s Most Powerful Women in 2023.

Anand Daniel:

Position: Nominee Director (Non-Executive) on the Board since July 10, 2015.

Education:

- Bachelor’s degree in Engineering (Computer Science) from the University of Madras.

- Master’s degree in Engineering from Purdue University.

- Master’s degree in Business Administration from the Massachusetts Institute of Technology (MIT).

Previous Experience: Worked with Accel India Management LLP for 4 years.

Current Role: Partner at Accel Partners India LLP for 10 years.

Ashutosh Sharma:

Position: Nominee Director (Non-Executive) on the Board since June 21, 2017.

Education:

- Bachelor’s degree in Electronic Engineering from Banaras Hindu University.

- Master’s degree in Business Administration from the Booth School of Business at the University of Chicago.

Current Role: Investment Partner, Growth+ at MIH Internet India Private Limited.

Experience: Associated with the Prosus Group for over 7 years.

Previous Roles: Served as Vice President at Norwest Venture Partners and worked at Qualcomm India Private Limited.

Sumer Juneja:

Position: Nominee Director (Non-Executive) on the Board since July 27, 2021.

Education: Bachelor of Science from the London School of Economics and Political Science, University of London.

Current Role: Managing Partner and Head of Europe, Middle East, and Africa (EMEA) and India at SB Investment Advisers (UK) Limited.

Previous Experience: Associated with entities affiliated to SB Investment Advisers (UK) Limited for 4 years.

Past Role: Director at NVP Venture Capital India Private Limited for over 9 years.

You may also like to read:

Best mutual funds to invest in 2024: Top rated Mutual Funds

Disclaimer: No content on this website should be treated as investment advice. All the content offered on the website is for informational purposes only. Please contact your adviser before making an investment.