Table of Contents

1. About the Company

UPL Ltd, formerly known as United Phosphorus Limited, is a global leader in sustainable agriculture solutions. Founded in 1969, UPL has grown to become the 5th largest agrochemical company worldwide, with a presence in over 138 countries.

The company is principally engaged in the business of agrochemicals, industrial chemicals, chemical intermediates, and speciality chemicals, as well as the production and sale of field crops and vegetable seeds.

UPL’s mission is to transform global food systems through its OpenAg network, which focuses on creating sustainable growth for all. With 14,000+ product registrations and access to 90% of the world’s food basket, UPL plays a crucial role in global food security and agricultural advancement.Key facts about UPL:

- Founded: 1969

- Headquarters: Mumbai, India

- Global presence: 138+ countries

- Manufacturing facilities: 43 across the globe

- R&D centers: 18 dedicated facilities

- Employees: Over 14,000 worldwide

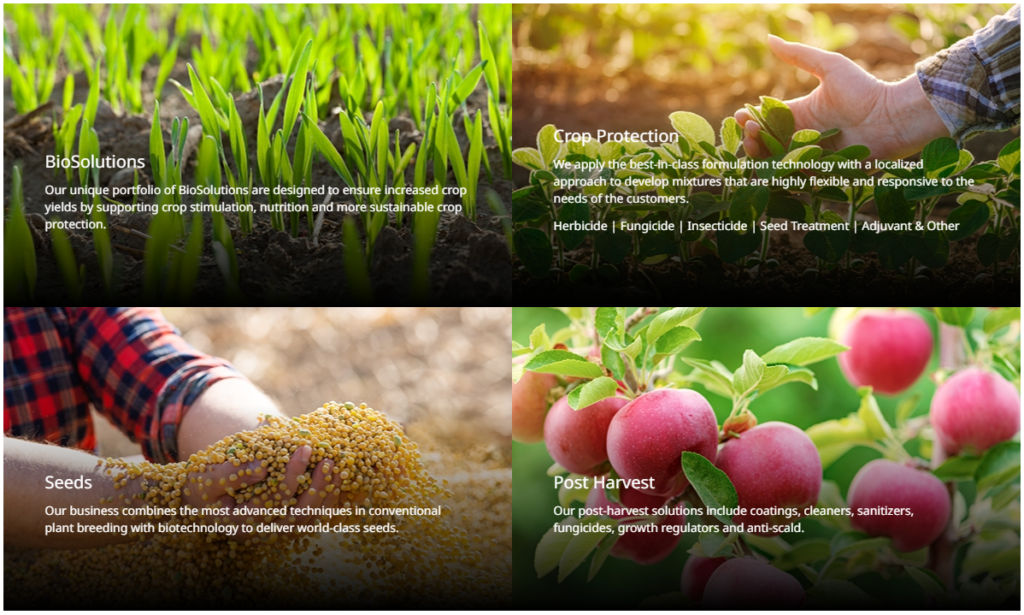

2. Products

UPL offers a comprehensive range of products across various categories:

- Crop Protection Chemicals:

- Insecticides

- Fungicides

- Herbicides

- Plant Growth Regulators

- Fumigants

- Seeds:

- Field crops

- Vegetable seeds

- Biosolutions:

- Biostimulants

- Biocontrol agents

- Soil health products

- Post-harvest Solutions:

- Storage and preservation technologies

- Ripening agents

- Industrial Chemicals:

- Specialty chemicals

- Chemical intermediates

Product Analysis:

a) Crop Protection Chemicals:

- Market share: Approximately 25% of UPL’s revenue

- Key products: ULALA (insecticide), MANCOZEB (fungicide), GLUFOSINATE (herbicide)

- Growth drivers: Increasing pest resistance, climate change impacts

b) Seeds:

- Market share: About 15% of revenue

- Focus areas: Hybrid and GM seeds for corn, rice, vegetables

- Growth potential: High, due to increasing demand for high-yield varieties

c) Biosolutions:

- Fastest-growing segment: 20%+ CAGR

- Key products: ProNutiva platform, integrating biological and conventional crop protection

- Market opportunity: Projected to reach $18.9 billion by 2026

d) Post-harvest Solutions:

- Emerging focus area for UPL

- Addressing food waste and extending shelf life

- Potential to capture significant market share in developing economies

e) Industrial Chemicals:

- Diversification strategy

- Leveraging expertise in chemical manufacturing

- Contributes to overall revenue stability

UPL’s product portfolio demonstrates a strong focus on innovation and sustainability, positioning the company well for future growth in the evolving agricultural landscape.

3. Results and Performance

Key Financial Information (Consolidated Figures in ₹ Crores):

| Particulars | FY 2024 | FY 2023 | FY 2022 | FY 2021 |

|---|---|---|---|---|

| Revenue | 43,098 | 53,576 | 46,240 | 38,694 |

| EBITDA | 5,515 | 11,178 | 9,529 | 8,352 |

| Net Profit | -1,200 | 3,569 | 4,437 | 3,495 |

| EPS (₹) | -14.21 | 42.28 | 42.18 | 33.40 |

| Debt-Equity | 1.13 | 0.97 | 0.95 | 1.12 |

| ROCE (%) | 3.29 | 13.70 | 13.80 | 12.70 |

Financial Analysis:

- Revenue: Declined by 19.56% in FY 2024 due to challenging market conditions and pricing pressures.

- EBITDA: Significant drop of 50.66% in FY 2024, reflecting margin compression and higher input costs.

- Net Profit: Turned negative in FY 2024, primarily due to lower sales and increased finance costs.

- Debt-Equity: Slight increase, indicating higher leverage in challenging times.

- ROCE: Sharp decline in FY 2024, reflecting reduced profitability and operational efficiency.

4. UPL hitorical share price

52-week Stock Summary:

- High: ₹625.96

- Low: ₹497.20

- UPL Share Price NSE Today

Past 12-month Stock Performance (Monthly Open, High, Low, and Close):

Here’s the data presented in a tabular format:

| Month | Open | High | Low | Closing Price | Change % |

|---|---|---|---|---|---|

| Dec-24 | 546.90 | 572.70 | 493.00 | 501.00 | -8.07% |

| Nov-24 | 531.08 | 558.75 | 483.75 | 545.00 | 2.62% |

| Oct-24 | 587.06 | 599.53 | 496.36 | 531.08 | -9.70% |

| Sep-24 | 577.46 | 598.28 | 558.81 | 588.16 | -1.70% |

| Aug-24 | 575.00 | 604.00 | 520.00 | 598.35 | 4.60% |

| Jul-24 | 570.05 | 580.30 | 522.30 | 572.05 | 0.21% |

| Jun-24 | 517.00 | 578.70 | 478.00 | 570.85 | 12.20% |

| May-24 | 508.10 | 540.00 | 464.35 | 508.80 | 0.33% |

| Apr-24 | 460.00 | 513.90 | 458.45 | 507.15 | 11.22% |

| Mar-24 | 474.00 | 491.05 | 447.80 | 456.00 | -2.92% |

| Feb-24 | 536.30 | 540.65 | 452.15 | 469.70 | -12.65% |

| Jan-24 | 588.00 | 603.80 | 533.55 | 537.70 | -8.44% |

5. UPL Ltd share price Target

Predicted share price targets based on financial analysis and estimated growth:

| Year | Target Price (₹) | Potential Upside |

|---|---|---|

| UPL Ltd share price Target 2024 | 630 | 14.54% |

| UPL Ltd share price Target 2025 | 699 | 27.09% |

| UPL Ltd share price Target 2026 | 750 | 36.36% |

| UPL Ltd share price Target 2027 | 792 | 44.00% |

| UPL Ltd share price Target 2028 | 843 | 53.27% |

| UPL Ltd share price Target 2029 | 910 | 65.45% |

| UPL Ltd share price Target 2030 | 1,033 | 87.82% |

| UPL Ltd share price Target 2035 | 1,550 | 181.82% |

| UPL Ltd share price Target 2040 | 2,325 | 322.73% |

Reasons for expected upside:

- Recovery in global agricultural markets

- Expansion in high-growth biosolutions segment

- Debt reduction initiatives improving financial health

- Increasing focus on sustainable agriculture solutions

- Potential for margin expansion through cost optimization

- Strategic acquisitions and partnerships enhancing market position

- Emerging market growth, particularly in Africa and Latin America

- Innovation in climate-resilient crop protection solutions

- Favorable government policies supporting agricultural productivity

- Long-term global food security concerns driving demand for UPL’s products

6. Key Management Personnel

- Jaidev Rajnikant Shroff – Chief Executive Officer

- Age: 59

- With UPL since: October 1, 1992

- Anand Kathrinal Vora – Director of Finance/CFO

- Age: 61

- With UPL since: August 5, 2013

- Tamhane Toshan – Chief Operating Officer

- Vicente Gongora – Chief Technology Officer

- Paresh Talati – Chief Technology Officer

- With UPL since: January 1, 1994

- Rajnikant Devidas Shroff – Chairman Emeritus

- Age: 91

- With UPL since: September 16, 2006

- Vikram Rajnikant Shroff – Director/Board Member

- Age: 51

- With UPL since: April 22, 2006

7. Management Commentary

Key points from recent management statements:

- Market Conditions: “We delivered significantly improved financial results in Q4 versus the two preceding quarters, despite the prevailing volatile and challenging market conditions.” – Mike Frank, CEO, UPL Corporation Ltd.

- Product Performance: “Our recent launches of Evolution, Feroce and Shenzi did exceedingly well, growing volumes by >50%.” – Management Statement

- Debt Reduction: “Net debt reduced significantly by $1.1 Bn from $3.8 Bn at the end of Dec’23 to $2.66 Bn at the end of FY24 through better working capital management.” – Financial Report

- Future Outlook: “We expect revenue growth between 4% and 8% in FY25.” – Management Guidance

- Strategic Focus: “UPL is focusing on unlocking value in subsidiaries and improving financial health through debt reduction and strategic investments.” – Analyst Call Summary

8. Dividend History

| Financial Year | Dividend Per Share (₹) | Dividend Type |

|---|---|---|

| 2023-24 | 10 | Final |

| 2022-23 | 10 | Final |

| 2021-22 | 10 | Final |

| 2020-21 | 6 | Final |

| 2019-20 | 8 | Final |

9. Corporate Action History

- Rights Issue (November 26, 2024):

- Ratio: 8:1

- Face Value: ₹2

- Premium: ₹358

- Purpose: To raise funds for debt reduction and strategic investments

- Investment Agreement (November 21, 2024):

- Partner: Alpha Wave Global

- Investment: USD 350 Million in Advanta Enterprises Limited (UPL’s subsidiary)

- Valuation: Advanta valued at approximately USD 2.85 Billion

- Joint Venture Agreement (May 23, 2024):

- Partner: Aarti Industries

- Purpose: Manufacturing and marketing of specialty chemicals

- Expected Revenue: Peak annual potential of ₹400-500 crores in 2-3 years

- Name Change (2013):

- From: United Phosphorous Ltd.

- To: UPL Limited

- Acquisition (July 26, 2011):

- Company: DVA Agro Do Brasil

- Stake: 51%

10. Key Conference Points

- Differentiated Portfolio Growth: Share of differentiated and sustainable portfolio increased by ~700 bps YoY to 35% of crop protection revenue for FY24.

- Regional Performance: Strong performance noted in Europe and Rest of the World regions.

- Cost Management: Reduced SG&A expenses by 17% YoY to ₹2,209 crore in Q4 FY24.

- Innovation Focus: Emphasis on developing climate-resilient and sustainable agricultural solutions.

- Digital Initiatives: Progress on the Nurture digital platform, connecting over 3 million farmers.

- Sustainability Goals: Commitment to reducing environmental impact and promoting sustainable farming practices.

- Market Expansion: Plans to further penetrate emerging markets, especially in Africa and Southeast Asia.

- R&D Investment: Continued focus on research and development to maintain competitive edge.

- Supply Chain Optimization: Efforts to improve operational efficiency and reduce costs.

- Strategic Partnerships: Exploring collaborations to enhance product offerings and market reach.

11. Top 10 Shareholders

| Shareholder | Stake (%) | Number of Shares |

|---|---|---|

| Demuric Holdings Pvt Ltd. | 21.70% | 183,232,965 |

| Life Insurance Corporation of India (Investment Portfolio) | 6.468% | 54,618,419 |

| UNIPHOS ENTERPRISES LIMITED | 5.265% | 44,459,378 |

| MFS International (UK) Ltd. | 3.242% | 27,373,563 |

| Suresight Ventures Ltd. | 1.738% | 14,678,380 |

| Jaidev Rajnikant Shroff | 1.19% | 10,046,825 |

| Vikram Rajnikant Shroff | 0.96% | 8,106,680 |

| Vanguard Group, Inc. | 0.89% | 7,515,450 |

| BlackRock Fund Advisors | 0.76% | 6,417,800 |

| Norges Bank Investment Management | 0.68% | 5,742,000 |

12. Peers

| Company Name | Market Cap (₹ Cr) | P/E Ratio | 1-Year Return |

|---|---|---|---|

| UPL Ltd | 41,606 | – | -18.36% |

| PI Industries Limited | 65,337 | 39.8 | +6.27% |

| Sumitomo Chemical India Ltd | 26,635 | 35.2 | +15.40% |

| Coromandel International Ltd | 25,890 | 15.7 | -5.80% |

| Rallis India Ltd | 5,750 | 28.9 | -12.50% |

13. FAQs

- Q: What is UPL’s main business focus?

A: UPL primarily focuses on providing sustainable agricultural solutions, including crop protection chemicals, seeds, and biosolutions. - Q: How has UPL’s financial performance been in recent years?

A: UPL faced challenges in FY 2024 with a revenue decline and net loss, but has shown resilience in previous years with consistent growth. - Q: What is UPL’s global market position in the agrochemical industry?

A: UPL is currently the 5th largest agrochemical company globally, with operations in over 138 countries. - Q: How is UPL addressing sustainability in agriculture?

A: UPL is focusing on developing biosolutions, sustainable crop protection products, and digital farming solutions to promote sustainable agriculture. - Q: What recent strategic moves has UPL made?

A: UPL has recently entered into investment agreements, joint ventures, and launched a rights issue to strengthen its market position and financial health. - Q: How does UPL’s dividend policy look?

A: UPL has consistently paid dividends in recent years, with a final dividend of ₹10 per share in the last three financial years. - Q: What are the key growth drivers for UPL in the coming years?

A: Key growth drivers include expansion in biosolutions, emerging market penetration, innovation in climate-resilient products, and strategic partnerships. - Q: How is UPL managing its debt?

A: UPL is actively working on debt reduction through improved working capital management and strategic fundraising initiatives like the recent rights issue. - Q: What sets UPL apart from its competitors?

A: UPL’s strengths include its global presence, diverse product portfolio, focus on sustainability.

Reader may also like

Adani Enterprise (ADEL) Share Price Target

Disclaimer: No content on this website should be treated as investment advice. All the content offered on the website is for informational purposes only. Please contact your adviser before making an investment.